Small business tax deductions are essential for reducing taxable income and maximizing savings. A comprehensive PDF checklist helps organize expenses, ensuring compliance and audit readiness while identifying eligible deductions.

Overview of Tax Deductions for Small Businesses

Small businesses can significantly reduce their taxable income by leveraging various tax deductions. These deductions cover a wide range of expenses, from office supplies and equipment to travel and meal costs. Vehicle expenses, home office deductions, and professional fees are also common eligible deductions. A small business tax deductions checklist PDF provides a structured approach to identifying and organizing these expenses, ensuring no potential savings are overlooked. Proper documentation, such as receipts and mileage logs, is crucial for compliance and audit preparedness. By understanding the types of deductions available, businesses can maximize their tax savings and maintain financial health. A checklist simplifies the process, helping owners stay organized and informed.

Common Small Business Tax Deductions

Common deductions include office supplies, travel expenses, and vehicle costs. A PDF checklist helps track these expenses, ensuring accuracy and maximizing tax savings for businesses.

Home Office Deduction

The home office deduction allows businesses to deduct expenses for a dedicated workspace used regularly for operations. Eligible costs include rent, utilities, and office supplies. The IRS offers two methods: the simplified option, which provides a flat rate per square foot, and the actual expenses method, requiring detailed records. A PDF checklist can help track these expenses, ensuring compliance with IRS regulations. Proper documentation, such as logs or receipts, is essential to support claims and avoid audit issues. This deduction is particularly beneficial for remote workers and small businesses operating from home, helping reduce taxable income significantly.

Vehicle Expenses for Business Use

Vehicle expenses are a significant tax deduction for small businesses. The IRS allows businesses to deduct costs related to using a car, van, or truck for work. Eligible expenses include fuel, maintenance, insurance, and parking fees. A PDF checklist can help track mileage and expenses. Businesses can choose between the standard mileage rate or the actual expenses method. Keeping a logbook with dates, miles driven, and purposes of trips is crucial for documentation. Deductions apply only to the percentage of vehicle use for business purposes, not personal use. Proper records ensure compliance and maximize tax savings, making vehicle expenses a valuable deduction for small businesses. This deduction can significantly reduce taxable income when accurately documented.

Business Expense Categories

Small businesses can deduct expenses across various categories, including office supplies, travel, meals, vehicle costs, rent, utilities, and payroll. A PDF checklist helps organize these deductions effectively.

Office Supplies and Equipment

Office supplies and equipment are common deductions for small businesses. Items like stationery, computers, and furniture qualify if used exclusively for business. A PDF checklist ensures tracking of these expenses, maximizing tax savings. Proper documentation, such as receipts, is crucial for audit purposes. Businesses can deduct the full cost of supplies purchased during the tax year or depreciate equipment over time. Keeping organized records helps verify eligibility and compliance with IRS guidelines. Regularly updating the checklist ensures no deductible items are overlooked, streamlining the tax filing process and optimizing financial benefits.

Travel and Meal Expenses

Travel and meal expenses are deductible if related to business activities. Keep logs of trips, including dates, destinations, and purposes. Meals are deductible at 50% if business-related, with receipts and details. A PDF checklist helps track these expenses, ensuring compliance. Document transportation costs, lodging, and meals separately. Proper records prevent audit issues and maximize deductions. Ensure expenses are reasonable and directly tied to business operations. This organized approach simplifies tax filing and optimizes savings, making it easier to claim eligible expenses without oversight.

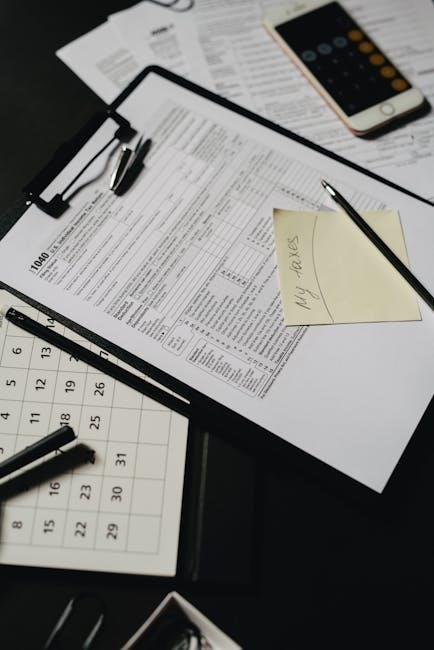

Documentation and Record-Keeping

Maintaining organized records is crucial for tax deductions. Keep receipts, mileage logs, and expense documentation. A PDF checklist ensures all records are audit-ready and easily accessible.

Importance of Receipts and Logs

Accurate receipts and logs are vital for substantiating tax deductions. The IRS requires documentation for expenses like fuel, lease payments, and parking fees. Maintain detailed records of business mileage, as vehicle deductions depend on logbook entries. Without proper receipts, deductions may be disallowed. Organize expenses categorically, such as office supplies or travel, to ensure compliance; A PDF checklist can help track these documents efficiently. Penalties for non-compliance can be costly, making thorough record-keeping essential. Regularly updating logs and storing receipts securely minimizes audit risks. This practice ensures transparency and supports claims during tax filing, safeguarding your business interests.

Audit-Ready Documentation Practices

Maintaining audit-ready documentation ensures compliance with IRS requirements and minimizes audit risks. Organize receipts, invoices, and expense logs digitally or physically, categorizing them by type and date. Regularly update records to reflect current expenses and ensure accuracy. Secure storage, such as cloud backup or locked files, protects critical documents. Use a PDF checklist to verify the completeness of records, ensuring no deductions lack support; Detailed logs for mileage, meals, and travel are particularly scrutinized. Consulting a tax professional can help tailor practices to IRS standards, reducing audit concerns. Proactive documentation practices not only streamline tax filing but also build confidence in the event of an audit, ensuring your business is prepared and compliant.

Maximizing Your Tax Savings

Maximize tax savings by strategically identifying eligible deductions and credits using a small business tax deductions checklist PDF, ensuring accurate expense tracking and optimal financial benefits.

Strategies for Claiming Deductions

To effectively claim deductions, small businesses should categorize expenses, track mileage for vehicle use, and maintain detailed records. Utilize a small business tax deductions checklist PDF to ensure no eligible expenses are overlooked. Prioritize documenting ordinary and necessary costs, as these are critical for valid claims. Regularly reviewing financial records and consulting a tax professional can also uncover additional savings opportunities. By implementing these strategies, businesses can optimize their tax savings and ensure compliance with IRS regulations. Proper organization and proactive planning are key to maximizing deductions and streamlining the tax filing process.

Tax Credits for Small Businesses

Tax credits for small businesses provide direct reductions in tax liability, offering significant savings. Credits like the Research and Development (R&D) Tax Credit reward innovation, while the Work Opportunity Tax Credit (WOTC) incentivizes hiring from specific groups. Additionally, credits for renewable energy investments and disabled access improvements are available. A small business tax deductions checklist PDF can help identify eligible credits and streamline the claiming process. Unlike deductions, credits directly reduce the amount of tax owed, making them highly valuable. Small businesses should consult tax professionals to ensure they maximize these opportunities and comply with eligibility requirements.

Creating a Small Business Tax Deductions Checklist

A small business tax deductions checklist PDF simplifies tracking eligible expenses, ensuring no deduction is missed. It covers common categories like home office, vehicle, and office supplies, helping maximize savings and stay audit-ready.

PDF Checklist for Easy Reference

A small business tax deductions checklist PDF is a valuable tool for organizing and tracking eligible expenses. It provides a structured format to ensure no deduction is overlooked, covering categories like home office expenses, vehicle mileage, office supplies, and travel costs. By using a PDF checklist, businesses can easily reference and mark off items as they gather necessary documentation. This tool helps streamline the tax preparation process, ensuring compliance with IRS regulations and maximizing potential savings. Many checklists are tailored to U.S. tax laws, offering a user-friendly way to stay organized and audit-ready. Downloading a comprehensive PDF checklist can significantly simplify tax filing for small business owners.

Using a small business tax deductions checklist PDF ensures organized and compliant tax filing. It simplifies tracking expenses, maximizing savings, and meeting IRS requirements for small businesses.

Final Tips for Filing Your Taxes

When filing taxes, ensure accuracy by cross-referencing expenses with a small business tax deductions checklist PDF. Organize receipts, logs, and financial records to support each deduction claim. Consider consulting a tax professional to avoid errors and ensure compliance with IRS regulations. Double-check deadlines and submit returns promptly to prevent penalties. Utilize the checklist to identify often-overlooked deductions, such as home office expenses or vehicle mileage, which can significantly reduce taxable income. By staying organized and informed, small businesses can optimize their tax strategy and maintain financial health.